If everyone in your organisation is awarded an annual salary, then this bit of setup is easy. More often than not though, it’s not quite that simple. Organisations might have hourly paid staff, weekly paid staff, employees who get 13 payments a year because they get an extra payment in the summer just in time for the holidays (hello Sweden, you lucky people) and all sorts of other things going on.

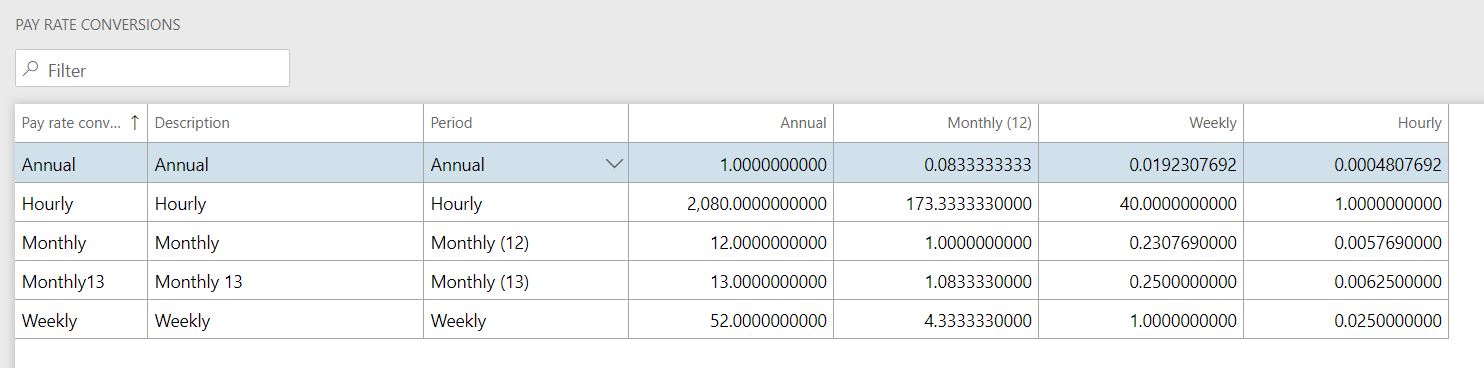

You need a way of being able to compare their pay together, where you’re comparing like for like, and that’s where your pay rate conversions table (Compensation management > Links > Fixed compensation > Pay rate conversions) comes in.

This is another bit of setup which is legal entity specific, so it needs to be repeated and localised wherever you are paying employees. Essentially what you’re going to do is take all the different variations on pay, and indicate how Talent should treat them when calculating a standard comparable rate, to show the value as one of the following:

- Annual

- Monthly (based on 12 equal installments)

- Weekly

- Hourly

It helps to have a reasonable grasp of maths at this point.

Let’s take the obvious example first. When we record pay rates for our annual salaried staff, we refer to, talk about and enter an annual value (even though they then get paid in 12 equal installments). These staff work 40 hours per week. So we create a pay rate conversation called ‘UKSalaried40’, give it a description such as ‘UK Salaried Staff 40 hpw’, and select the period (the value we’re actually entering) as ‘Annual’.

Now, we need to tell Talent how to convert that figure to each of the bulleted items above for this group of staff.

The first one’s easy – to convert an annual value to an annual value, we multiply it by 1. So we enter a 1 in that column

The second one is kind of easy. If we want to convert this annual figure into a 12 monthly installments figure we need to divide it by 12. But we can’t enter 1/12 in this field because it only accepts numbers. So we whip out a calculator, do 1/12, and enter 0.083333333 into this field.

How you calculate weekly and hourly rates will vary depending on your organisation and it might be an idea to have a chat with colleagues in payroll to see what they do when it comes to making deductions for unpaid leave. Chances are they’ve got all these calculations already defined and you can just borrow them. I’ve seen a variety of approaches to each (annual salary divided by 365.25 days in a year – accounting for leap years – then multiplied by seven is my favourite annual to weekly conversion). If, however, you can’t see any conceivable reason why you’d ever need to do this and the thought of all that maths leaves you cold, leave hourly and weekly blank. It limits you slightly on what sort of reporting you can do but it’s not the end of the world.

When you’ve finished, you should have a table that looks something like this:

(Note that the descriptions here aren’t actually that descriptive. I recommend using something which tells you the weekly working hours of each group as your hourly conversions will take that into account and therefore be specific to that group of staff. The examples in the table above assume a 40 hour working week).

Last step before we get to the real meat of the thing – defining fixed compensation actions.

1 thought on “Fixed compensation translated – 6 – Pay rate conversions”